November 26, 2002

November 26, 2002

Honorable Terri Vaughan

Division of Insurance, State of Iowa

330 E. Maple Street

Des Moines, IA 50319

RE: Lloyd’s American Trust Funds

Equitas American Trust Fund

Dear Commissioner Terri Vaughan:

This is the second in a series of letters regarding the lack of substantive regulation of Lloyd’s. This dearth of regulation is primarily due to the failure of the New York Insurance Department ("NYID") to fulfill its duties and obligations to fellow regulators and policyholders across the United States.

Over the decades, reliance on the NYID has conditioned state insurance departments throughout the U.S. to unquestioningly depend on the NYID to properly monitor Lloyd’s.

The purpose of this letter is to illustrate why continued trust in the NYID is misplaced, and to address the lack of audits of the Lloyd’s and Equitas American Trust Funds.

Many U.S. regulators have two fundamental misconceptions about Lloyd’s:

1. That the U.K. government, through the Financial Services Authority ("FSA"), audits Lloyd’s financial solvency. (They don’t; they "rely on insurer reports")

2. That the NYID routinely audits Lloyd’s and Equitas’ U.S. trust funds. (The only audit was published in 1995)

Presently, the European Commission is investigating the British Government for failure since the mid-1970’s to properly apply an EC directive to audit arrangements at Lloyd’s.[1] The EC is clearly concerned about the reliability of the financial reports published by Lloyd’s and solvency of the Lloyd’s market. We believe you should share the EC’s concern.

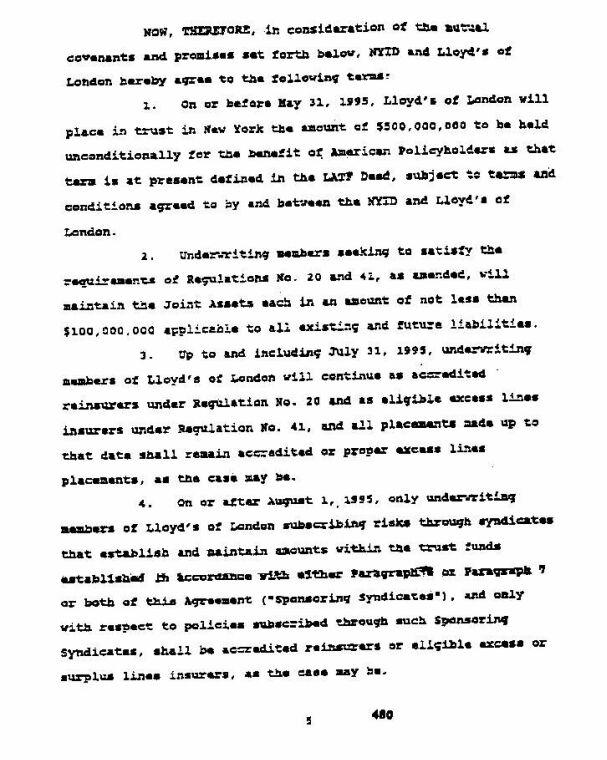

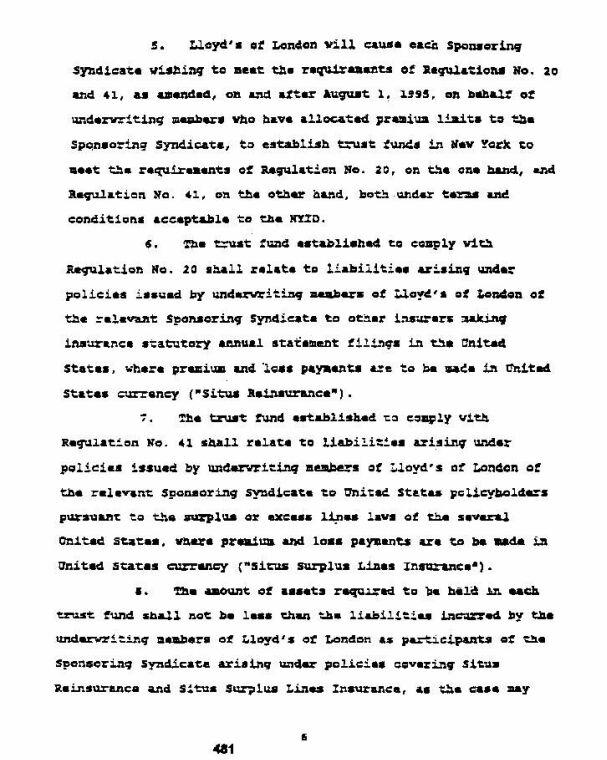

Since 1977, Lloyd’s has been transacting the business of insurance in the U.S. as an accredited reinsurer and approved non-admitted insurer based upon its agreement to maintain on deposit in the State of New York specific amounts mandated by New York Insurance Department ("NYID") regulations. However, during an audit of Lloyd's trust funds by the NYID published in May 1995, state examiners discovered that the deposits in Lloyd's American Trust Funds ("LATF") were deficient by over $18.47 billion on a gross basis! As a result, in May 1995, NYID’s then Superintendent Ed Muhl, required Lloyd’s to retain 100% of liabilities in separate, newly established trust funds for Lloyd’s U.S. surplus lines and reinsurance business.[2]

American Names Association / U.S. Insurance Commissioners

Page two / 11-26-02

Despite the fact that Lloyd’s has incurred more than $11.5 billion in losses since 1997 [3], and indications that Equitas may be insolvent, the NYID has not conducted another audit of any of these Funds to determine whether Lloyd’s and Equitas are in compliance. If the amounts on deposit in the Lloyd’s American Trust Funds and the Equitas American Trust Fund are deficient, the protection afforded to Lloyd’s policyholders and reinsureds in your state is illusory!

Why hasn’t the NYID audited the Lloyd’s and Equitas trust funds? We believe the NYID has failed to fulfill its duty to you and other state regulators because its senior executives are being unduly influenced by Lloyd’s and its advocates. We believe Lloyd’s leadership fears that revelation of its actual liabilities relative to its trust balances will expose its true financial condition and impair its approval status in the U.S. The negative impact Lloyd’s restructuring plans could have on 1993 to 2002 U.S. policyholders, however, makes an audit imperative.

In October 2001, at a special summit meeting of the NAIC in Washington, D.C., the NAIC assumed direct accountability for verifying the financial strength (or weakness) of Lloyd’s. The NAIC commissioned Arthur Andersen to conduct a "thorough examination" of Lloyd’s.[4] The NAIC’s statements and releases to the press led the public, ceding reinsurers and industry observers, including many state regulators, to believe that the examination would include a thorough examination of Lloyd’s post 9-11 financial condition.[5]

We have been informed, however, that instead of verifying any of Lloyd’s financial data, Andersen only focused on Lloyd’s procedures and safeguards. The NAIC has not published even a summary of Andersen’s report, and discussions of Andersen’s findings by an NAIC oversight committee have been confined to closed executive sessions, but reliable sources have described the report as being essentially "useless". If the NAIC feels that the Andersen report is useless, a new examination including an audit of Lloyd’s American Trust Funds should be ordered without further delay.

We believe that you and other state regulators cannot rely on the NYID to fulfill its oversight obligations to you and Lloyd’s U.S. policyholders. The only way you can prudently decide whether to allow Lloyd’s underwriters to continue to transact insurance in your state as approved non-admitted carriers is to know their true financial condition, and require compliance with your own state’s laws. Until the trust funds have been thoroughly audited and you are personally satisfied that the mandated balances are on deposit, there is no way you can assure your constituents that their claims will be paid in full.

It is essential that state insurance departments mandate and regularly confirm that adequate balances are in Lloyd’s and Equitas’ U.S. Trust Funds, and that the trusts are maintained in compliance with their respective Trust Deeds.

American Names Association / U.S. Insurance Commissioners

Page three / 11-26-02

Lloyd’s is writing and renewing policies every day, while implementing its plan to convert from a "market" to a "brand name" franchiser. If you and other state insurance regulators do not require Lloyd’s to prove that the American trusts are properly funded, who will? Without an audit, on what basis can U.S. insureds make informed decisions about placing risks with Lloyd’s?

We call upon all Commissioners to compel an audit of all the Equitas and Lloyd’s American Trust Funds, such audit to be

- conducted by a firm other than Arthur Andersen;

- supervised by Examiners from at least three (3) states, excluding Georgia, Texas and New York; and

- memorialized in a report of the examination available to the public, as is the case with domestic insurers.

Please take a moment to read the enclosures. If you would like a complete copy of the 2001 Lloyd’s Global Results or have any questions, please feel free to contact our office.

Sincerely,

American Names Association

J. F. "Jack" Shettle, Sr.

Chairman

cc: Fifty-four (54) Insurance Commissioners in the United States and territories

Endnotes:

1. Source: European Panel Warns British Government

Again Over Lloyd’s Insurance Market,Knight Ridder Tribune Business News,

10-17-02

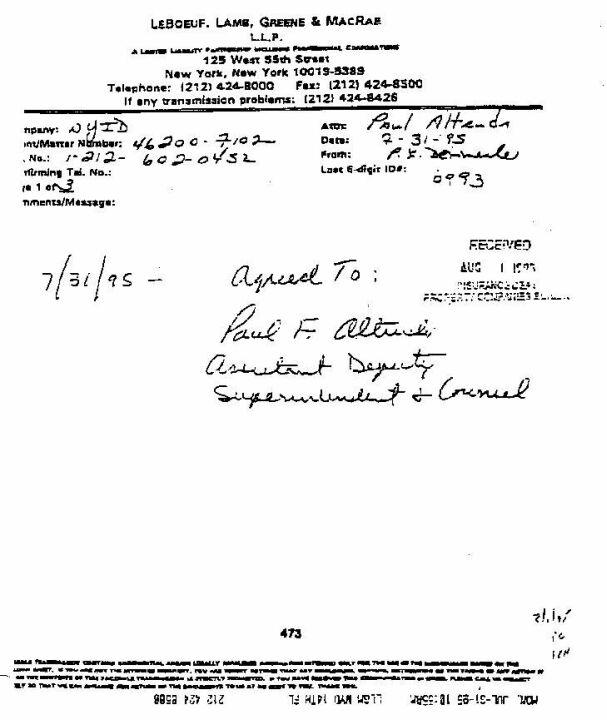

2. Source: Stipulation Agreement Between

Lloyd’s and the NYID, 5-24-95.

3. Source: Lloyd’s Global Reports, Compilation

of aggregate market losses for 1997 to 2001 years of account

4. Source: NAIC Members Clarify Requirements

for Lloyd’s Trust Funds, NAIC News Release, 10-23-01

5. Source: Lloyd’s in Solvency Probe, BBC

News, 11-05-01

Reports - | - Contact Truth About Lloyd's

European Panel Warns British Government Again over Lloyd's Insurance Market

October 17, 2002 12:00am

(c) 2002, Financial Mail on Sunday, London.

Source:Knight-Ridder

/ Tribune Business News via NewsEdge Corporation : Oct. 16—

The European Commission is threatening fresh legal action against the Government over its alleged failure to regulate the Lloyd's insurance market.

Frits Bolkestein, financial services commissioner in Brussels, has already started legal proceedings against the Government, claiming it did not properly apply an EC directive on audit arrangements at Lloyd's.

Bolkestein said his concerns had been heightened by a recent High Court ruling, which found that investors in the giant insurance market had been exposed to multi-billion pound losses because of the system of auditing.

Now the Commission is threatening the Government with action -- which could lead to a case in the European Court of Justice -- over its current regulation of Lloyd's.

The Financial Services Authority, which took over responsibility for Lloyd's last year, has said it intends to tighten the rules.

Bolkestein also told MEPs that he has not ruled out instigating proceedings over Equitas, the insurance vehicle set up by Lloyd's to handle its asbestos losses.

The EC has received complaints that Equitas is technically insolvent, which it denies. Its accounts are, however, qualified by auditors each year on the basis that it is impossible to estimate future asbestos liabilities.

-------------------

| Compilation of Lloyd's aggregate market losses | |||||

| for the 1997 to 2001 years of account | |||||

| year | year loss (£ millions) | cumulative (£ millions) | conversion factor | year loss ($ millions) | cumulative ($ millions) |

| 1997 |

-£209

|

-£209

|

£1 = $1.55 |

-$324

|

-$324

|

| 1998 |

-£1,065

|

-£1,274

|

£1 = $1.55 |

-$1,651

|

-$1,975

|

| 1999 |

-£1,952

|

-£3,226

|

£1 = $1.55 |

-$3,026

|

-$5,000

|

| 2000 |

-£1,720

|

-£4,946

|

£1 = $1.55 |

-$2,666

|

-$7,666

|

| 2001 |

-£3,110

|

-£8,056

|

£1 = $1.55 |

-$4,821

|

-$12,487

|

| Sources: Lloyd's Global Reports and announcements | |||||

NAIC Press Release

October 23, 2001

NAIC Members Clarify Requirements for Lloyd’s Trust Funds

WASHINGTON, D.C. (Oct. 23, 2001) -- During a regulator roundtable at the National Association of Insurance Commissioners (NAIC) Commissioners Summit here, the Reinsurance Task Force withdrew its recommendation to allow Lloyd’s to temporarily extend the timing of their 100 percent funding requirements relating to their Sept. 11 losses.

The task force’s preliminary recommendation was withdrawn following discussions of the NAIC membership and the Reinsurance Task Force regarding the need to fully evaluate any liquidity issues on a syndicate-by-syndicate basis prior to granting an extension applicable to the entire Lloyd’s market.

Rather, the task force reported that the 100 percent funding requirement would be maintained for all multiple beneficiary trust reinsures. In the event of any funding levels of less than 100 percent, the task force agreed to work closely with the New York Insurance Department, as domiciliary regulator of the trusts, to perform the necessary analysis and identify appropriate remedies.

The task force also reported that an examination of Lloyd’s will commence prior to Dec. 31, 2001, to analyze and verify the loss estimates prepared by Lloyd’s. The purpose of the examination is to assess the security provided to U.S. insurers who transfer risk to Lloyd’s.

About the NAIC

Headquartered in Kansas City, Mo., the National Association of Insurance Commissioners (NAIC) is a voluntary organization of the chief insurance regulatory officials of the 50 states, the District of Columbia and four U.S. territories. The association’s overriding objective is to protect consumers and help maintain the financial stability of the insurance industry by offering financial, actuarial, legal, computer, research, market conduct and economic expertise. Formed in 1871, it is the oldest association of state officials. For more information, visit NAIC on the Web at www.naic.org/pressroom.

BBC NEWS, November 5, 2001

Lloyd's in solvency probe

Lloyd's: Confident it can foot the

bill

Monday, 5 November, 2001, 17:13 GMT

US regulators have launched an investigation into the solvency of the world's oldest insurance market, Lloyd's of London. If Lloyd's can not meet its liabilities, that could cause serious financial problems, possibly even insolvency for American primary insurers

The National Association of Insurance Commissioners (NAIC) fears Lloyd's will not be able to meet all of its liabilities - estimated at more than $6bn - resulting from the terror attacks of 11 September.

The NAIC has brought in accountants Arthur Andersen to conduct an audit, which is designed to ensure American insurers are not left out of pocket by the unprecedented flood of claims following the suicide attacks on Washington and New York. If at any stage in the process, Lloyd's is deemed unable to meet its liabilities it will be banned from the reinsurance business in the US.

'Serious' liquidity problem

John Oxendine, the commissioner for

Georgia who is heading the investigation, said Lloyd's had already given

the US authorities figures on its estimated gross and net liabilities.

"We basically want to verify those figures," he told the BBC's World Business Report.

"The scale of the liabilities of 11 September was phenomenal and because of that Lloyd's has admitted that it has a very serious liquidity problem.

"We suspect that liquidity problem is short term. Lloyd's says it is short term and we have no reason to disbelieve Lloyd's," Mr Oxendine added.

'Financial problems'

However, Mr Oxendine added: "We need

to come in and verify that it is definitely short-term and not something

more serious.

"If it turned out to be something more than a short-term problem and we don't go in to check then we would look like we are not doing our job.

"If Lloyd's can not meet its liabilities that could cause serious financial problems, possibly even insolvency for American primary insurers."

Long-term gains

Lloyd's recently made a cash call

on its individual members - the so-called 'names' - to help it meet the

cost of 11 September. But it has said it is confident it can easily absorb

all of the claims.

In the longer term, the insurance market stands to benefit from a massive increase in insurance premiums. According to newspaper reports, several companies - backed by investment banks - are preparing to join the Lloyd's market, bringing in an estimated $5bn of new capacity.

The final bill for insurers of 11 September has been estimated as high as $40bn.

Home

- | - Regulation

- | - Litigation

- | - News -

| - Fraud

Reports - | - Contact

Truth About Lloyd's