Lloyd's Chairman Peter Levene and ANA Chairman Jack Shettle Sr.,

February 19 to March 22, 2004

Mar. 22, 2004 - letter

to Lloyd's Chairman Peter Levene from ANA Chairman Jack Shettle

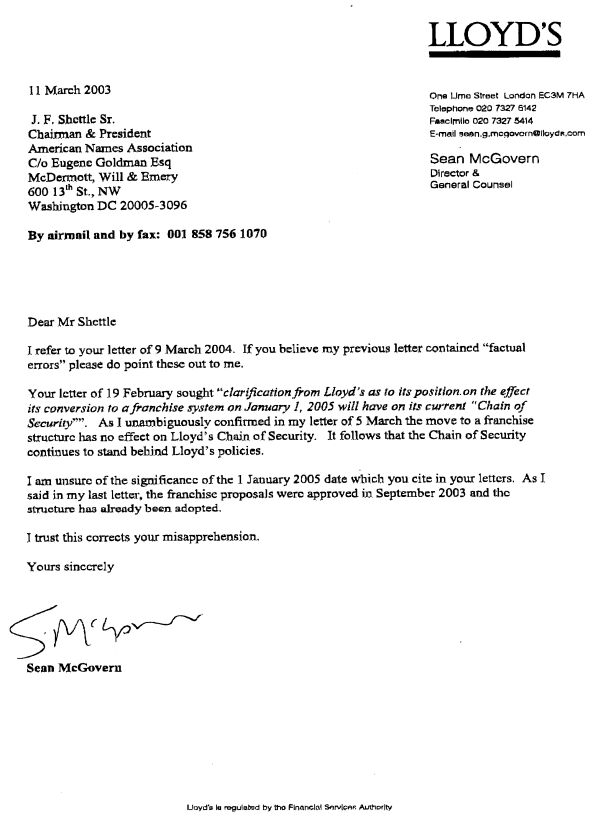

Mar. 11, 2004 - letter

from Chairman Levene to Chairman Shettle

Mar. 09, 2004 - Shettle to Levene

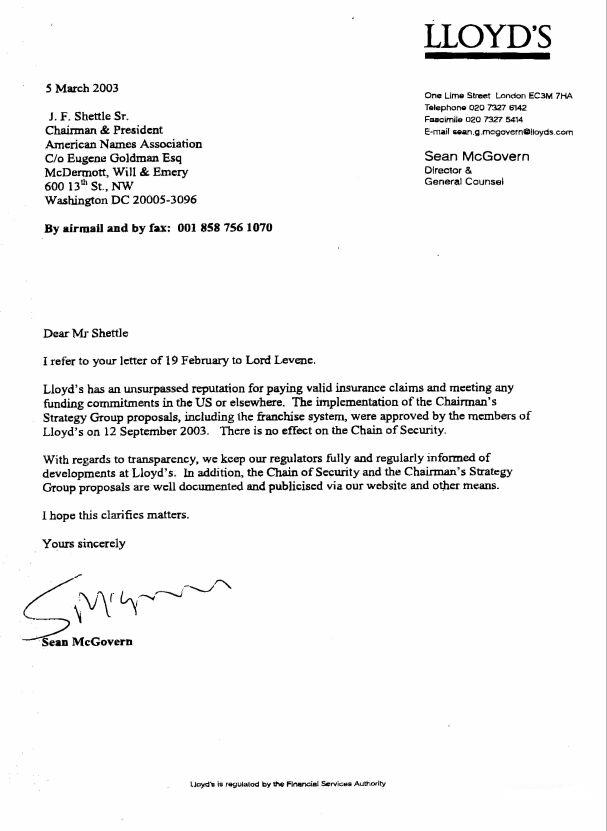

Mar. 05, 2004 - Levene to Shettle

Feb. 19, 2004 - Shettle to Levene

Feb. 19, 2004 - Attachment: ANA Calls for Increase of Lloyd’s U.S. Trust Fund Collateral

March 22, 2004

Sean McGovern, Esq.

Director & General Counsel

Lloyd’s

One Lime Street

London EC3M 7HA

England

Dear Mr. McGovern:

Your recent letters to me on behalf of Chairman Levene (both erroneously dated "2003") require an answer solely to set the record straight.

Your statements regarding the supposedly "unsurpassed" claims payment record of Lloyd’s and its "reputation for . . . meeting any funding commitments . . ." are nothing more than public relations rhetoric. These statements do not answer our fundamental question, which I restate here for clarity:

Will Lloyd’s Members underwriting in years of account 2005 and onward be required to contribute to any Central Fund that guarantees payment of claims asserted against existing and previous Members who do not meet their policyholder obligations for 1993 through 2004 years of account?

If the "proposals . . . website and other means" to which you refer answer this question, why have you not cited the specific, relevant text on this point?

That January 1, 2005 is a significant milestone in the implementation of many key features of the so-called franchise structure is clearly evident from reading what has been published on this most recent of three reorganizations of the enterprise known as "Lloyd’s" that have occurred in the past 10-years.

We are disappointed that Lloyd’s is unwilling or unable to provide a definitive answer to our primary question. All interested parties, including the ANA, are entitled to know if Lloyd’s, the franchiser, will require its present and future Members/capital providers to stand behind all policies issued under its trade name after 1992.

We thank you for your attention to our letters and regret that further correspondence on this subject seems futile.

Very truly yours,

J.F. Shettle, Sr.

Chairman

back to top

March 9, 2004

Sean McGovern, Esq.

Director & General Counsel

Lloyd’s

One Lime Street

London EC3M 7HA

England

Dear Mr. McGovern:

I have received and reviewed your letter dated "5 March 2003," (sic). I appreciate the courtesy of your reply, although it contains factual errors.

I would have preferred receiving an unambiguous answer to my question about whether or not the obligations of Lloyd’s Members who underwrote policies and reinsurance agreements prior to January 1, 2005 will be guaranteed by a Central Fund supported by contributions from its Members after 2004. This issue cries out for a simple and unequivocal answer such as "yes this is so" or "no it is not so."

For the sake of good order, I respectfully request that you clarify in plain terms, once and for all, whether Lloyd’s the franchiser and its franchisees will stand behind all policies issued under the Lloyd’s trade name after January 1, 1993. I look forward to your reply.

Very truly yours,

J.F. Shettle, Sr.

Chairman

February 19, 2004

Lord Peter Levene

Chairman

Lloyd's

One Lime Street

London, England

Dear Lord Levene:

The purpose of this letter is to seek clarification from Lloyd's as to its position on the effect its conversion to a franchise system on January 1, 2005 will have on its current "Chain of Security."

Because many American Names Association (ANA) members underwrote during the 1993 and 1994 years of account, they have a right to know if Lloyd's does not intend to maintain its present Chain of Security after January 1, 2005.

In the absence of any clear public pronouncements by Lloyd's, it appears that the capital provided by Lloyd's franchisees after 2004 will not be available to cover any claims against the current premium trust funds or present Central Fund. Whether the reorganization into a franchise will entail a new or partitioned Central Fund, and new and separate Lloyd's American Trust Funds for business going forward, is equally unclear.

At two NAIC quarterly meetings, as well as a seminar sponsored by the American Bar Association, I and/or ANA's Executive Director Jeffrey Peterson, stated on the record that we have not seen any evidence that Lloyd's has made an organizational or contractual commitment to stand behind policies written after December 31, 1992 and prior to January 1, 2005.

Because lawyers representing Lloyd's were present during our presentations, we specifically invited them to deny or refute our assertions. The only response we are aware of was made verbally during the December 2003, NAIC meeting held in Anaheim, California by a Mr. Walmsley (purportedly a Lloyd's employee). He stated, "the reorganization of the Lloyd's market will not affect the trust funds or the ability of Lloyd's to stand behind liabilities on policies written before or after January 1, 2005." Our concern is that "ability" is not synonymous with "obligation."

Letter to Lord Peter Levene

Page two / 02-19-04

A verbatim copy of the ANA’s presentation to the Reinsurance Task Force of the NAIC on December 6, 2003 is attached for your review. I am sure you will agree that if our assertions were incorrect, it would be in Lloyd's best interest to strongly deny them publicly, in writing.

One of the stated objectives of Lloyd's new franchise structure is "transparency." We believe the most effective way Lloyd's can make its intent clear is to provide the New York Superintendent of Insurance and other states' regulators with written confirmation that Lloyd’s the franchiser and its franchisees will finance and maintain an unbroken Chain of Security that will guarantee its commitments to pre-franchise era policyholders and reinsureds. For "clear" transparency, confirmation of Lloyd's commitment should be widely distributed to the US insurance and financial press.

We respectfully ask that you favor us with a written affirmation that the Lloyd's franchise will stand behind all policies issued under the Lloyd's trade name after January 1, 1993. While we sincerely hope that our concerns are unfounded, if we do not hear from you within the next two weeks we will assume they are warranted.

Very truly yours,

J F Shettle, Sr

Chairman

Back to Top - Exhibit A - Exhibit B - Exhibit D - Exhibit E - Letter to Acctg Firms

Reports - | - Contact Truth About Lloyd's